By Nick Niemann & Matt Ottemann, McGrath North

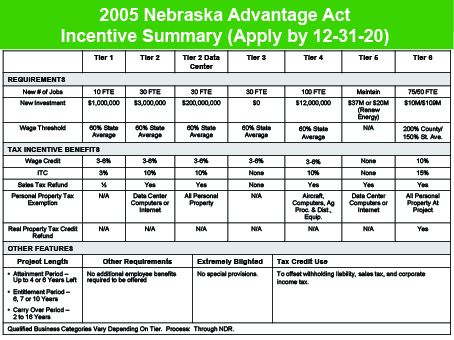

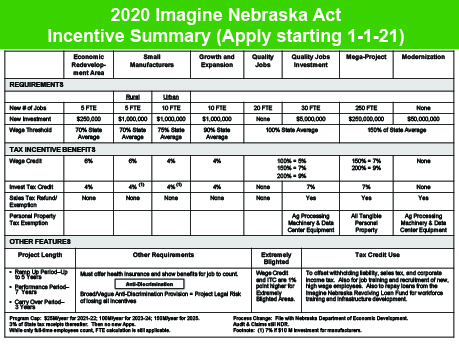

Governor Pete Ricketts and the Nebraska Legislature have provided a strong, timely, and helpful new Tax Incentive Platform: The 2020 ImagiNE Nebraska Act. The ImagiNE Nebraska Act was enacted August 17, 2020, and becomes effective on January 1, 2021. It replaces the 2005 Nebraska Advantage Act, which had previously replaced the 1987 Employment and Investment Growth Act.

Key Changes Under the ImagiNE Nebraska Act

The ImagiNE Nebraska Act is substantially different from the Nebraska Advantage Act. In many ways it is better, and in some compromised, negotiated ways it is not as strong. Key differences include the following:

- Incentive Mix. Different levels of income, sales, and property tax incentives apply based on new required levels of jobs and investment.

- Immediate Incentive Use. Incentives may generally be claimed once a business attains the required investment and employment thresholds. Companies need not complete a Qualification Audit prior to claiming incentives (which was, for many companies, holding up incentives).

- No Segregation of Qualified Locations. Locations will now qualify as long as a majority of the activities occurring at

that location are “qualified activities.” Companies should no longer need to segregate qualified and non-qualified activities at a given location. - Application Review By DED. Applications for incentives will now be reviewed by the Nebraska Department of Economic Development (DED). The Nebraska Department of Revenue will be responsible for auditing the levels of employment and investment, as well as approving a company’s refunds, credits, and exemptions.

- Expansion of Qualified Activities. The listing of qualified business activities has expanded.

- Wage Levels. For most projects, employers must pay at least the state average wage for a new employee to count towards meeting the employment thresholds. Lower wage requirements apply for certain manufacturers and companies engaged in aircraft servicing.

- Employee Benefits. Employers must offer new employee health insurance and benefits for that employee to count towards meeting the employment thresholds.

Grandfather Decision By December 31, 2020

While the ImagiNE Nebraska Act “replaces” the 2005 Nebraska Advantage Act, in fact the state of Nebraska has given companies a big choice. For a limited period of time (through December 31, 2020), you can actually choose which tax incentive platform is best for you.

The reason this choice exists is because under the Nebraska Advantage Grandfather provision, you have four to six years to actually meet the new job and investment thresholds—if you file the Nebraska Advantage Application by December 31, 2020. So, even if you are presently uncertain about your future growth, you can file your application by December 31, 2020, and then have until 2024-2026 to actually implement your expansion (and then continue to earn the potentially higher Nebraska Advantage Act tax incentive benefits for six to 10 years after that).

In essence, this becomes a grandfathered “protective filing.” If you decide later to change your site or your plans, you can do so. Or, if you decide later you won’t reach the new job and investment threshold, you can simply withdraw the application (and if you so choose, switch and then file under the ImagiNE Nebraska Act).

There are 15 specific business, legal, and financial criteria that determine

which platform will be better for your specific project.

The new anti-discrimination provision in the 2020 ImagiNE Nebraska Act weighs heavily in favor of filing a Grandfather “protective filing” Nebraska Advantage Application by December 31, 2020, even if by the numbers ImagiNE Nebraska looks better for you.

The anti-discrimination provision was offered as a well-intentioned senatorial amendment and was adopted. The 2020 ImagiNE Nebraska Act says the incentive agreement between the company and the state “shall” include a “requirement that the taxpayer not violate any state or federal law against discrimination.”

So, on its face, this broad and vague condition can mean that any such violation (whether or not adjudicated) by any employee of the taxpayer anywhere in the country becomes a breach of the contract, which could have the unintended consequence of the loss of all project incentives.

This becomes a significant risk to any company that is depending on the incentive in making its expansion decision. This could also lead to a burdensome audit by the Nebraska Department of Revenue, which by law needs to assure compliance with the Act.

Perhaps the Department of Revenue will find a defensible way to make this workable.

Hopefully, the 2021 Legislature will refine the provision. However, if a company waits until then to find out, it will be too late to file a 2020 Grandfather Application under the Nebraska Advantage Act.

We welcome the opportunity to discuss this with you, as business leaders continue to quickly adjust and refocus their business models towards the future.

Nick Niemann and Matt Ottemann are partners with McGrath North Law Firm. As state and local tax and incentives attorneys, they collaborate with CPAs to help companies evaluate and deploy the optimal incentive programs for their clients and to address incentive issues with the appropriate state or local agency. Learn more at www.NebraskaStateTax.com. For a copy of their publication, Nebraska Tax Incentive Briefing, please call Nick or Matt at (402) 341-3070 or

email them at nniemann@mcgrathnorth.com or

mottemann@mcgrathnorth.com, respectively.

This story appears in 2020 Issue 5 of the Nebraska CPA Magazine.