Effective Jan. 1, 2023, last year’s passage of Nebraska’s LB310 resulted in various changes to Nebraska’s inheritance tax laws. These changes include adjusted tax rates and exemptions, a slightly adjusted classification of beneficiaries, and a new reporting requirement. The purposes of this article are to provide some background on Nebraska inheritance tax and to summarize the recent changes.

As general, non-exhaustive background: Inheritance tax usually must be addressed when wrapping up the affairs of a deceased Nebraska resident (or a deceased non-resident who owned property located in Nebraska at death). Generally, the tax is imposed on assets that were:

(i) received by an individual as the result of the decedent’s death,

(ii) conveyed by the decedent to an individual prior to the decedent’s death in “contemplation” of death (e.g., certain gifts), or

(iii) intended to take effect in possession or enjoyment by an individual after the decedent’s death.

Revenue generated from inheritance tax typically is paid to the county in which the decedent resided at death (or, in the case of a non-resident, to the county in which property belonging to the decedent was located at death).

Inheritance tax must be paid within one year of death; otherwise, interest on the unpaid tax will accrue at 14% annually, a penalty may be assessed, and the executor of the decedent’s estate may be required to give a bond to guarantee payment of the tax. Upon the decedent’s death, a statutory lien arises on all real estate owned by the decedent in Nebraska (unless the sole recipient is the decedent’s spouse) until the tax has been formally addressed, which can complicate a sale or use of such real estate as collateral for a loan. Life insurance proceeds received by a beneficiary other than the decedent’s estate and property received by the decedent’s spouse or children as a result of the homestead allowance, exempt property allowance, or family maintenance allowance are not subject to tax.

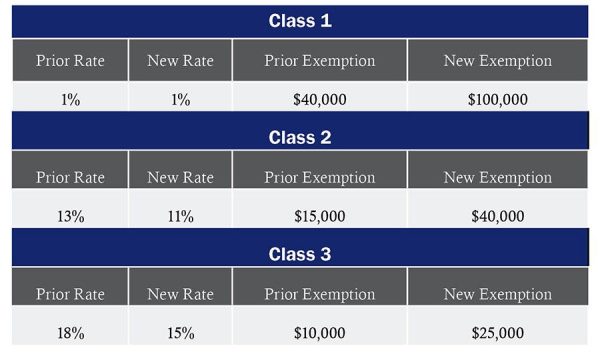

The table below summarizes the recent adjustments to the tax rates and exemptions, by “Class” of beneficiary:

Class 1: Grandparent, parent, sibling, lineal descendant (blood related and adopted), individual to whom the decedent for not less than 10 years prior to death stood in the acknowledged relation of a parent, and the spouse or surviving spouse of any such individuals.

Class 2: Aunt, uncle, niece, or nephew, blood related or adopted, and a lineal descendant or spouse or surviving spouse of any such individuals.

Class 3: An unrelated individual.

In addition to those identified as Class 1 and Class 2 beneficiaries above, individuals who formerly would have been classified as Class 3 beneficiaries due to their relationship to a decedent only by marriage may now be classified as Class 2 beneficiaries, as the definition of “relatives” for purpose of the classification has been expanded to include relatives of a spouse or former spouse of the decedent’s relatives, if the decedent’s relatives were married to the spouse at the death of the decedent or such spouse.

As a result of LB310 Nebraska law now provides that assets received by any individual who is under age 22 years at the decedent’s death, regardless of class, are entirely exempt from the inheritance tax.

New Reporting Requirement

Lastly, Nebraska law now mandates that personal representatives must submit a report to identify the number of resident and non-resident beneficiaries for each class, the total tax paid with respect to resident beneficiaries for each class, as well as the total inheritance tax paid with respect to each class. The report must be submitted to the county treasurer where the estate is administered, at the time estate assets are distributed from the estate. In turn, county treasurers now have an obligation to compile and submit an annual report to the Nebraska Department of Revenue (NDOR) regarding the data collected from personal representatives. As required by LB310, NDOR recently released its Estate County Inheritance Tax Report (Form ECIT) for use by personal representatives.

James Tews and Nick O’Brien are attorneys at Koley Jessen, focusing their practices on estate planning and administration. They work closely with families, individuals, and business owners to develop comprehensive estate plans in line with their unique personal, financial, and business objectives and ensure the proper execution of those plans when the time comes. For more information, contact them at james.tews@koleyjessen.com or nick.obrien@koleyjessen.com, respectively.