One of the more intriguing provisions of the Consolidated Appropriations Act (which was signed into law by President Biden on Dec. 29, 2022) is one that allows, for the first time,1 Qualified Charitable Distribution (QCD) treatment2 for IRA distributions that are made to certain split-interest trusts. Beginning in 2023, as a result of that provision, taxpayers may elect to treat as a QCD a distribution of up to $50,000 from an IRA to a charitable remainder trust.3

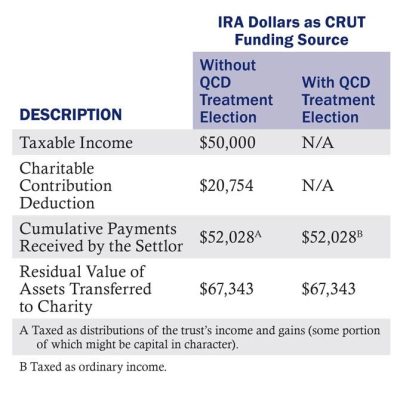

Scale, administrative cost, and income characterization limitations should be considered. The one-time qualifying distribution balance cannot exceed $50,000; the trust will include set-up and ongoing administrative costs; and distributions made by the trust to the settlor during the period the trust remains outstanding must be treated by the settlor as ordinary income.

In spite of its limitations, the provision might be of interest to certain customers4. To facilitate client conversations and to quantify sample outcomes—based upon 1) the January § 7520 rate, 2) the maximum $50,000 contribution balance, and 3) certain assumptions regarding payout rate, total return, trust term, payment timing, and payment interval—the following schedule demonstrates the various computations related to a fixed-term charitable remainder unitrust (CRUT) including the total payments received by the settlor, the residual value of the trust assets at the termination of the trust, and the charitable contribution deduction amount.

Customers might benefit from a conversation about the new split-interest trust QCD rule, even with its limitations. It’s an easily demonstrated discussion that can seamlessly accompany annual client conversations regarding qualified charitable distribution planning.

1. Insofar as I am aware.

2. Qualified Charitable Distribution treatment, generally, allows a taxpayer aged 70.5 or older to exclude from taxable income an IRA distribution (that would otherwise have been taxable) made directly to a qualifying charitable organization. A consequence of that income exclusion is that the donation is not deductible as an itemized deduction from AGI. The parallel scenarios are to either “include and deduct” or, instead, “exclude and not deduct.” QCD treatment enables the second scenario.

3. Charitable remainder trusts (i.e., Charitable Remainder Unitrusts (CRUTs) or Charitable Remainder Annuity Trusts (CRATs)), generally, provide an income stream to the settlor for some period (which might be a fixed number of years or, instead, be a period tied to the life of the settlor). At the end of that period, the trust terminates and the property of the trust is transferred to a charitable organization.

4. For example, those with relatively modest charitable priorities, those with higher administrative cost tolerances, those seeking to minimize taxable income, and those looking for an opportunity to “kick the tires” on a split-interest trust arrangement.

5. That’s a good trade. Even if the deduction is fully allowed (which is certainly not a given today), the tax savings on the net $29,246 decrease in taxable income might help fund a substantial portion of the resulting administrative costs related to creation and operation of the trust.

Bryan P. Robertson, JD, CPA provides trust and estate planning services for his wealth management clients. He also teaches the individual and corporate income tax courses at Nebraska Wesleyan University. For more information, contact him at broberts@nebrwesleyan.edu.